15+ oklahoma payroll calculator

Self-employed persons pay a total of 153 percent124 percent for. Take home pay calculator alabama.

Image 004 Jpg

We hope these calculators are useful to you.

. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Oklahoma. It typically takes 2 minutes or less to run payroll. If you work for yourself you need to pay the self-employment tax which is equal to both the employee and employer portions of the FICA taxes 153 total.

Calculating your Oklahoma state income tax is similar to the steps we listed on our Federal paycheck calculator. Calculate your Oklahoma net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Oklahoma. When you choose SurePayroll to handle your small business payroll.

Indicate your choices then select the Calculate button. Biweekly Pay Schedule. Sponsored Links Sponsored Links Payroll Information Paycheck Gross Pay.

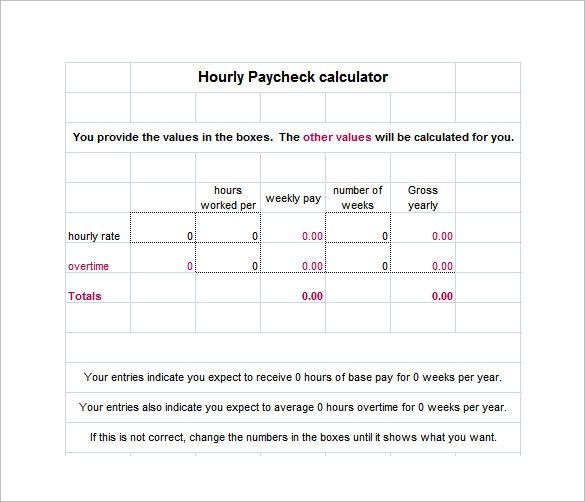

Some of these payroll taxes software have a calculator inbuilt in them. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Oklahoma.

So if you earn 001 per hour your annual salary is 1500 based on 1820 working hours per year which may seem a lot but thats only 1517 hours per month or 35 hours per week and your. Payroll Time Labor. Single filers will pay the top rate after.

The Oklahoma Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Oklahoma State. Complete all your payroll calculations in 3 easy steps. Run Your Own Payroll In.

Just enter the wages tax withholdings. Pay period number begin date. Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay.

Employers can use it to calculate net pay and figure out how. Supports hourly salary income and multiple pay frequencies. Figure out your filing status work out your adjusted gross income Net.

If payroll is too time consuming for you to handle were here to help you out. Lost ark stone cutting calculator. Wages deductions and payroll taxes completed automatically.

Oklahoma Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. Our income tax and paycheck calculator can help you understand your take home pay. Oklahoma Paycheck Calculator Use ADPs Oklahoma Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Tax rates range from 025 to 475. With six marginal tax brackets based upon taxable income payroll taxes in Oklahoma are progressive. Simply enter their federal and state W-4 information as.

Luckily when you file your. Remember that this amount is deducted from the generous Benefit Allowance provided by the State of Oklahoma. The employer can file payroll taxes in this state electronically by using a payroll software such as OKTAP.

Pay period dates begin on Sunday and end on Saturday. Payroll Deductions Online Calculator Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state for any type of payment.

Well do the math for youall you need to do is enter. If you make 201500 in Oklahoma what will your salary after tax be.

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

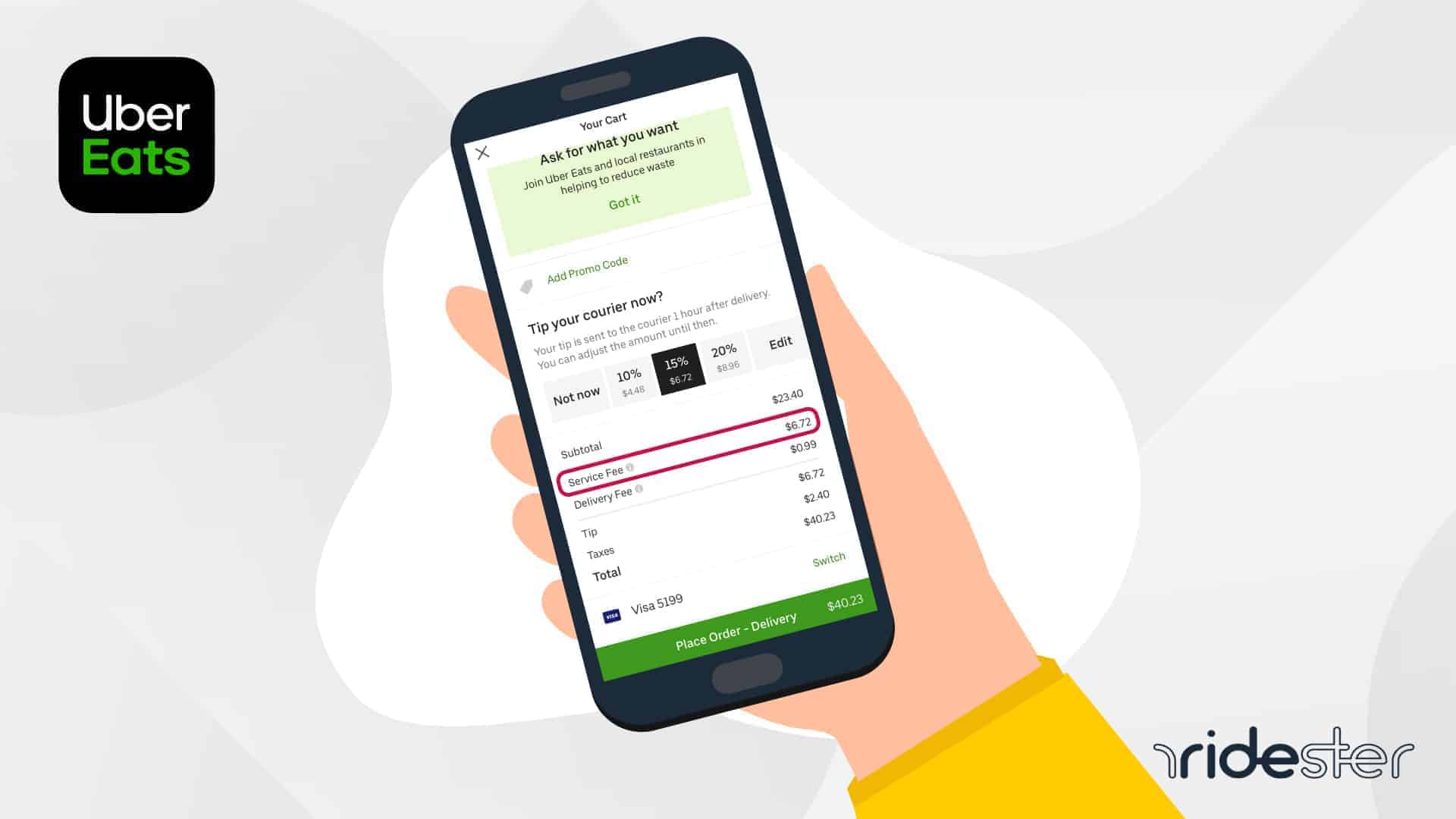

How Much Do Uber Drivers Make In 2022 Ridester Com

Oklahoma House Of Representatives Legislative Assistant Salaries Glassdoor

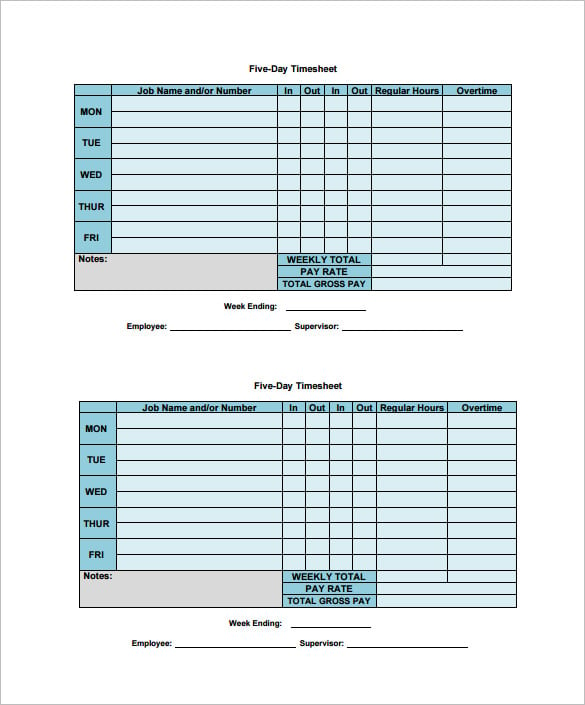

7 Weekly Paycheck Calculator Doc Excel Pdf Free Premium Templates

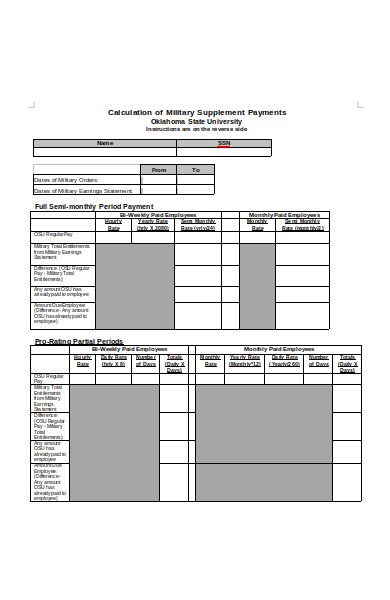

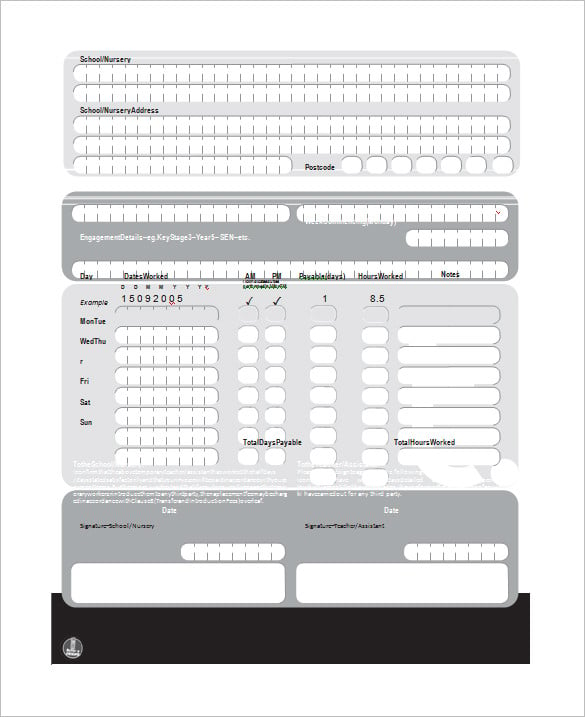

Free 31 Calculation Forms In Pdf Ms Word

Mortgage Protection Insurance Calculator 2022 Update

Oklahoma Salary Calculator 2022 Icalculator

Oklahoma Wage Calculator Minimum Wage Org

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Oklahoma Department Of Human Services Social Worker Salaries Glassdoor

Oklahoma Paycheck Calculator Smartasset

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Oklahoma S Population Growth Size Composition And Policy Implications Documents Ok Gov Oklahoma Digital Prairie Documents Images And Information

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Paycheck Calculator Take Home Pay Calculator

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates